You put a lot of effort into giving your family financial stability. But what if you experience an unforeseen circumstance? Who will provide for your family’s financial requirements while you are away? A few actions made now can safeguard their futures.

What is a term plan?

The most basic life insurance, term insurance, offers protection for a predetermined number of years. In case of the insurer’s untimely demise, while the policy is in effect, the nominee can receive a lump sum payment equal to the sum assured. You can read about term insurance tax benefits before opting for one.

Term insurance features that every policyholder should know

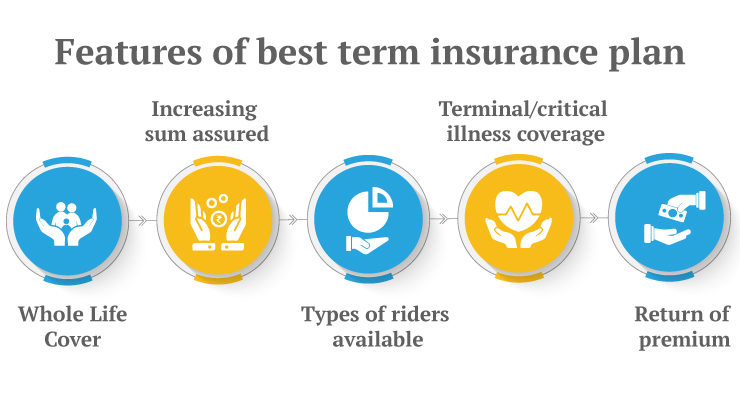

Some of the critical characteristics of term insurance policies that you must be aware of:

- Cost efficient:

These policies’ premiums are significantly less than conventional insurance policies because they do not have an investment component. The minimal cost of term insurance does not matter, though, because the most crucial goal is maintaining your family financially secure and self-sufficient in the tragic event.

- Pay the policy’s premium only until retirement.

Choose to pay premiums until age 60 and be protected for 85 years. Isn’t this a win-win scenario? Only until you begin working do you need to pay dividends for the entire term. For instance, if you are only 35 years old, a 50-year term insurance policy can cover your whole life until age 85. However, you can select a premium payment period that ends well before retirement. Choose the right plan for the best term insurance tax benefit.

You won’t have to worry about paying your life insurance premium after retirement when the average monthly income quits, thanks to a shortened premium payment period. Even when you retire, your term insurance can continue to protect your loved ones for the duration of the policy. However, a surcharge must be paid to receive this benefit. You should choose this critical feature since it protects your family’s financial future if any financial obligations persist beyond retirement.

- A monthly payout option

Remember that the payout type you select can affect your family’s financial stability while you are away. Even if your nominee is financially capable, having a regular paycheck can make things easier for them. Always opt for theterm insurance benefitsthat suit your individual situation.

Two types of monthly income plans:

- Fixed monthly income plan: Under the fixed monthly income option, the family is given a set monthly payment for a specific period. For instance, the nominee can get a fixed sum of Rs 40,000 per month for ten years if the term insurance sum assured chosen is Rs. 1 crore.

- Plan for increasing monthly income: With this option, the monthly payment can increase by 10% yearly. As the value of money declines over time, they are choosing the possibility of increasing income can assist their family in coping with inflation. For instance, the nominee can increase their monthly payout by 10% annually under a life insurance policy worth Rs. 1 crore. You can provide your family with inflation-proof financial protection in this way.

- Select Riders to Expand the Coverage of Your Term Plan

By providing the insured with additional protection, the riders or add-on benefits improve the policy’s scope of coverage. These add-on riders, which are offered with term insurance contracts, cost extra and include:

- Waiver of premium rider:If the policyholder becomes seriously ill or incapacitated, he will not be required to pay any more premiums.

- Critical Illness: The policyholder receives a lump sum payment under the critical illness rider in the event of an essential illness diagnosis.

- Accidental benefit rider: The term insurance payout increases during an accident. For instance, if the insured has a term policy with a sum assured of Rs. 50 lakh and an accidental rider of Rs. 15 lakhs, the insurance provider may pay the nominee Rs. 65 lakhs in the event of the insured’s demise due to the accident. There are several terms and conditions of a term plan. Ensure that you know them before making an abrupt purchase. Make sure you choose the best plan with the best term insurance features.

- Enhance or Increase the Insurance Coverage

Your financial obligations and liabilities grow along with you. It would help if you also upgraded your life insurance policy. You will typically need to purchase a new approach to enhance your term life insurance.

Your family’s financial security in times of need is the primary goal of insurance coverage. So, before purchasing a term insurance policy, be sure the insurer is a reputable company with a solid financial history and a consistent track record of claim settlement ratio. The total number of claims that the insurer settled throughout the fiscal year is shown by the claim settlement ratio in the insurance industry.

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.